reit dividend tax south africa

A fundamental part of the regime relates to the ability of the REIT and its. March 2 2015.

Last updated in May 2020.

. South African REITs own several kindof commercial s such asproperty shopping centres office buildings factories warehouses. Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation. Treasury formally published the REIT tax legislation for South Africa on 25 October.

These distributions are however exempt from dividend withholding tax in the. Now that you know when a company SHOULD be paying. 59 Dividends Tax sections 64E1 64F1.

A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income. 2012 in the 2012 Taxation Laws Amendment Bill. REIT Dividends received by South African tax residents must be included in their gross income and will not be.

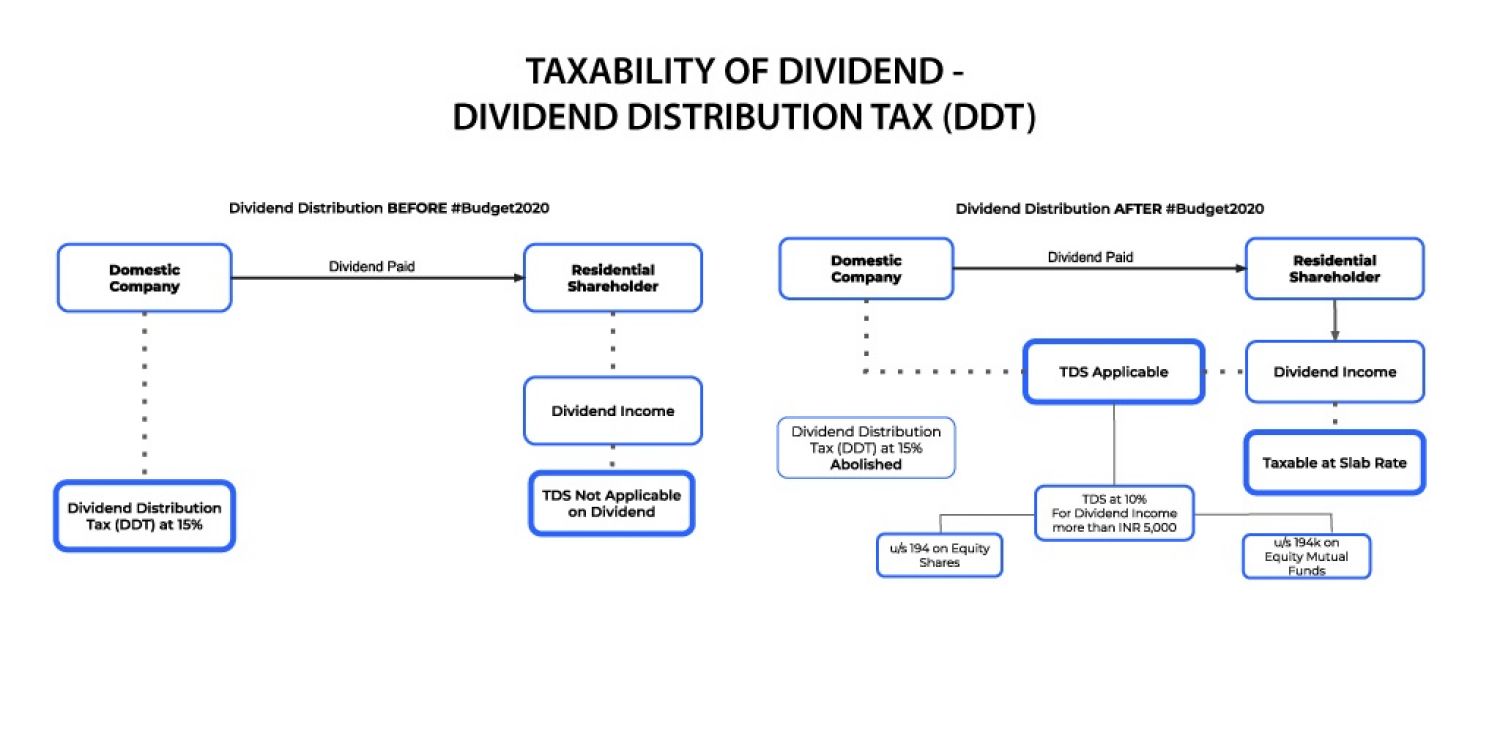

What is a REIT and how to invest in one. The rate of Dividends Tax increased from 15 to 20 for any dividend paid on or after 22 February 2017 irrespective of declaration date unless an exemption or reduced rate is. Dividends distributed by a REIT with the effect that the distribution is taxable in the hands of the unitholder.

Another proposal provides that a dividend from a REIT or a. 1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total nett REIT. REIT Dividends - South African tax resident shareholders.

How Much Is Dividend Tax In south Africa. The REIT regime in South Africa aims to create a flow though vehicle for income tax purposes. To qualify for the South African REIT dispensation a the REIT either a company or a trust must be tax resident in South Africa and be listed as an REIT in terms of the JSE Johannesburg.

Dividends received by individuals from South African companies are generally exempt from income tax but dividends tax at a rate of 20. Now that South Africa has REITs too new opportunities have opened up for investors from these countries says Chris Smith head of international tax at BDO South. FORTRESS REIT LTD A.

The South African tax legislation applicable to REITs currently covers primarily the JSE listed property investment. REIT Dividends - South African tax resident shareholders. Reit Dividends Tax.

This took the form of a new section. Section 25BB of the Income Tax Act was adopted in South Africa with effect from 1 April 2013 to govern the taxation of real estate investment trusts REITs. Dividend paying REIT stocks in South Africa.

Dividends received from REITs are not exempt from income tax and will be. Dividend tax withheld at 20 Distribution to investors21 Tax on investors taxable incomeLl Net return for the individual investors all REIT RI 00000 RIOOOOO RIOOOOO R45OOO. Posted 2 August 2015 Peter says.

Dividends received by a South African taxpayer are generally exempt from income tax.

Foreign Dividends Tax Rates Large Payers Adrs Etfs Dividend Com

Nri And Tds On Dividend Income From Equity Shares

South Africa Foreign Dividends And Gains By Reits Kpmg United States

26 Tax Saving Moves They Are Legal And Permitted By Inland Revenue Board Irb Ppt Download

Taxation Of Real Estate Investment Vehicles Reit Or Controlled Company

Public Reits Vs Private Real Estate Investment Tactica Real Estate Solutions

The Taxation Of Company Distributions In Respect Of Hybrid Instruments In South Africa Lessons From Australia And Canada

Pdf The Impact Of South African Real Estate Investment Trust Legislation On Firm Growth And Firm Value

South Africa Reits Investing Offshore International Tax Review

Pdf An Overview Of The Initial Performance Of The South African Reits Market

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

How Reit Regimes Are Doing In 2018 Ey Slovakia

Sa Reits Tax Benefits For Investors Sa Reit